What is ‘Higher for Longer’ and how does it impact your investment portfolio

Redacción Mapfre

The primary catalyst for markets over the last year and a half has been the shift in monetary policy by central banks on both sides of the Atlantic. This shift has had a significant impact on economic growth, price increases, and the behavior of both fixed-income and equity markets.

Economic growth is directly affected by these rate hikes, which is precisely the desired effect of central banks: historically, recessions have pushed prices down. However, the macroeconomic data is more resilient than expected, despite analysts’ predictions of a recession for this year.

The markets reacted negatively in all directions. While fixed-income securities improved their yields to a large extent, they experienced significant declines last year because rising interest rates meant new issuances paid higher interest, and bond prices in portfolios decreased.

Equities also fell sharply in 2022, especially in the case of growth stocks, which benefit from very low-interest rate scenarios. This has led investors to anticipate rate cuts that would boost these companies. Additionally, investors’ preference for fixed income, which offers lower risk and good returns, is contributing to this trend.

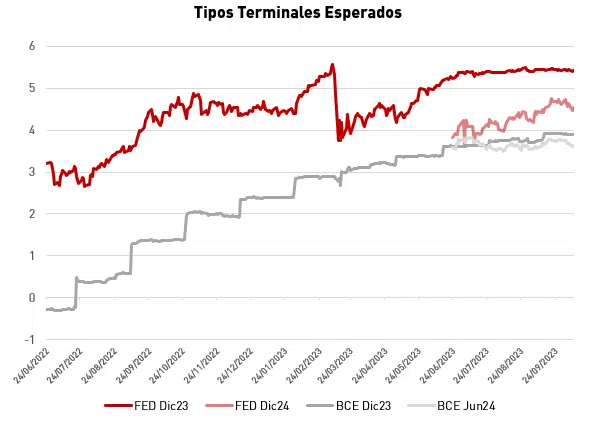

Thus, with interest rates in Europe at 4%-4.5% and in the United States at 5%–5.25%, expectations of rate cuts in the short term are starting to fade. The famous “higher for longer” mantra (higher interest rates for an extended period) has gained prominence in the last month, especially after statements by the Chairman of the U.S. Federal Reserve, Jerome Powell, at the central bank’s latest monetary policy meeting, and the decision of the European Central Bank (ECB) to raise official interest rates by 25 basis points for the tenth consecutive time, placing them at the highest level in Eurozone history.

Furthermore, market-discounted reference rates for December of next year have risen sharply in the last month, while those expected for December 2023 have remained stable.

This means that the markets are now pricing in fewer rate cuts. The impact on the markets has been swift, with the greatest damage focused on the performance of bonds. Inflation expectations discounted by the futures market (five-year rates in five years) have also adjusted upwards but remain at levels consistent with their historical average, as explained in the latest monthly report by MAPFRE Gestión Patrimonial.

These movements are pushing real interest rates (nominal rates minus inflation) into positive territory for the first time in Europe for a long time and to 2.5% in the United States, both of which are considered high enough to potentially harm growth. However, MGP holds the view that circumstances for anticipating short-term interest rate reductions are not in place unless an unforeseen financial crisis arises.

In fact, the advisory firm does not anticipate a return to the interest rate levels seen before the inflation increase in the short term. “The situation has changed, and it is hard for us to see rates returning to levels close to 0%,” explains Daniel Sancho, Head of Investments at MGP.

How does it affect your portfolio?

Monetary tightening has restored the appeal of fixed income, which offers attractive yields for investors without the need to assume excessive risk. However, the risk of central banks continuing to raise rates makes a longer duration less advisable for individual investors.

Enrique Palmer, Business Development Director at MAPFRE Gestión Patrimonial, explains that a duration of no more than four years is ideal, anticipating that interest rates will peak in the first quarter of 2024 and remain stable for some time.

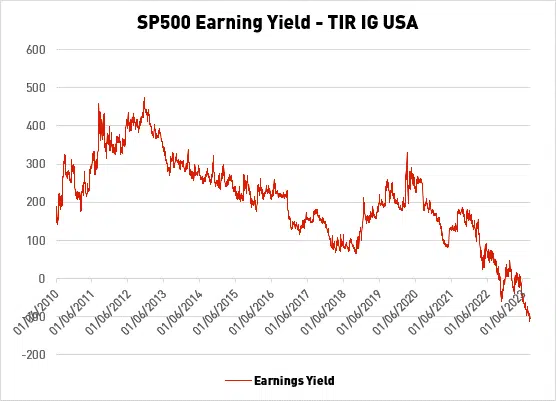

Meanwhile, investing in equities is not as attractive, as investors must take on more risk than in fixed income, not to mention the fact that the risk is not well compensated. In fact, opting for bonds over stocks may prove to be a more advantageous choice for the investor.

“If we look at the risk premium of equities versus credit, it is currently in the negative. In other words, based on valuations, it would make more sense to buy a company’s bond rather than its stock. Not only would you not be rewarded for the risk, but you would be paying for it,” says Javier de Berenguer, Investment Manager and Fund Selector at MAPFRE Gestión Patrimonial.

From an absolute valuation perspective, he explains that the major companies in the MSCI World Index have reversed or are even above the levels before the 2022 correction. “This does not make much sense, as growth expectations do not support this recovery, and interest rates are higher than they were a year ago, so valuations should be even lower than they were at the end of last year,” he says.

MGP believes that both absolute and relative valuations are “demanding enough” to warrant a cautious approach to the asset. De Berenguer adds that when fixed income stabilizes, “we can expect to see inflows from equities,” which could be another source of pressure for stocks.