These are the two scenarios for the global economy envisaged by MAPFRE Economics

Redacción Mapfre

The past few years have been shaped by the pandemic, a black swan event with far-reaching consequences: it has disrupted supply chains and altered consumption habits, initially boosting savings which later supported spending. Coupled with the geopolitical tensions of recent years, this makes forecasting economic activity for the coming months even more challenging. That’s why MAPFRE Economics, MAPFRE’s research arm, always considers two different scenarios in its report “2024 Economic and Industry Outlook: Second Quarter Perspectives.”

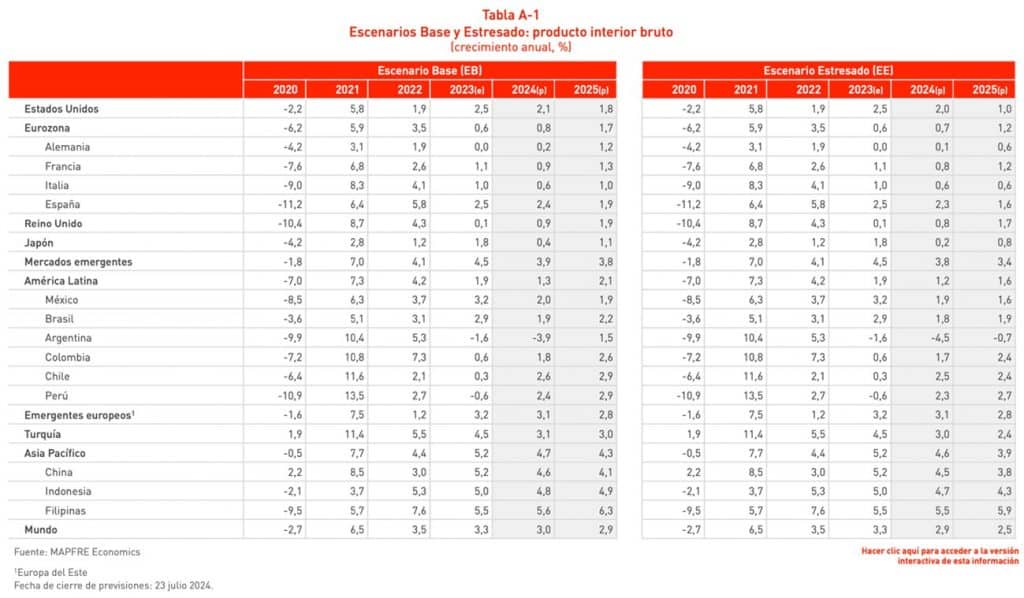

In the base scenario outlined in this report, which is deemed the most likely, global growth shows an improved economic outlook for 2024 and 2025, with anticipated growth rates of 3.0% and 2.9% for each year. This suggests that the recovery of potential growth is still incomplete. The slight boost in global activity is largely driven by marginally stronger contributions from some developed economies, such as the Eurozone. However, the primary source of momentum continues to be the expansion of emerging markets, particularly in Asia, which remains the main driver despite the relative weakness in China.

The inflation forecast for 2024 continues to show a downward trend, although it is expected to remain above short-term targets, averaging around 4.5%. For 2025, a more controlled inflationary environment is anticipated at a rate of 3.5%. This, along with a stronger economic performance, suggests a less stagflationary outlook compared to previous years.

In terms of monetary policy, a gradual shift towards neutral policies is anticipated. However, this transition may be less orderly than in the past, when synchronized economic cycles and evident coordination facilitated a more streamlined approach. Specifically, following a summer pause, the U.S. Federal Reserve (Fed) is expected to begin cutting interest rates in September, with subsequent reductions anticipated in other developed economies such as Europe and Canada. This shift should eventually benefit emerging economies, which, despite leading the monetary policy cycle, have found the final stretch of inflation less promising than anticipated by their own central banks.

Overall, the short-term global economic slowdown remains reflected in the forecasts, although there are slight upward revisions. In the medium term, there are expectations for a return to growth rates closer to potential, though the current arguments are not yet robust enough to fully support this outlook. Regarding inflation, further progress is needed in moderating price growth to justify neutral and less accommodative monetary policies.

Structural challenges continue to skew the risk map downward, and geopolitical risks persist as the most likely trigger for the stressed scenario.

Stressed scenario

The stressed scenario remains dominated by geopolitical risk premiums, which are channeled through various mechanisms to exert upward pressure on inflation. The source of the shock remains in energy commodities, with oil prices expected to reach $100 per barrel for two consecutive quarters before stabilizing around $90 throughout 2025.

This situation is expected to impact global prices, driving them up by nearly half a percentage point over 2024 and 2025. However, the effect on economic activity is likely to be relatively modest, with growth projected to be reduced by only one-tenth of a percentage point in 2024. A broader decline of half a percentage point is expected globally in 2025, reflecting some of the delayed effects of a more restrictive monetary policy. Although this scenario is unlikely to derail the overall economic trajectory, any easing measures by central banks would likely be implemented only towards the end of the year, after the peak effects of the shock have passed. These measures would be limited throughout 2025, focusing more on stabilizing prices rather than significantly boosting growth.

Financial conditions are expected to face increased stress, leading to a response in risk assets similar to past episodes. Typically, this would result in a 15% average correction in global equities and a 150 basis point widening of credit spreads. Investors are likely to shift towards a ‘flight to quality’ approach, favoring safe and high-quality assets amid heightened uncertainty.