Does the new ECB rate cut mark a turning point?

Redacción Mapfre

Eduardo García Castro, senior economist at MAPFRE Economics

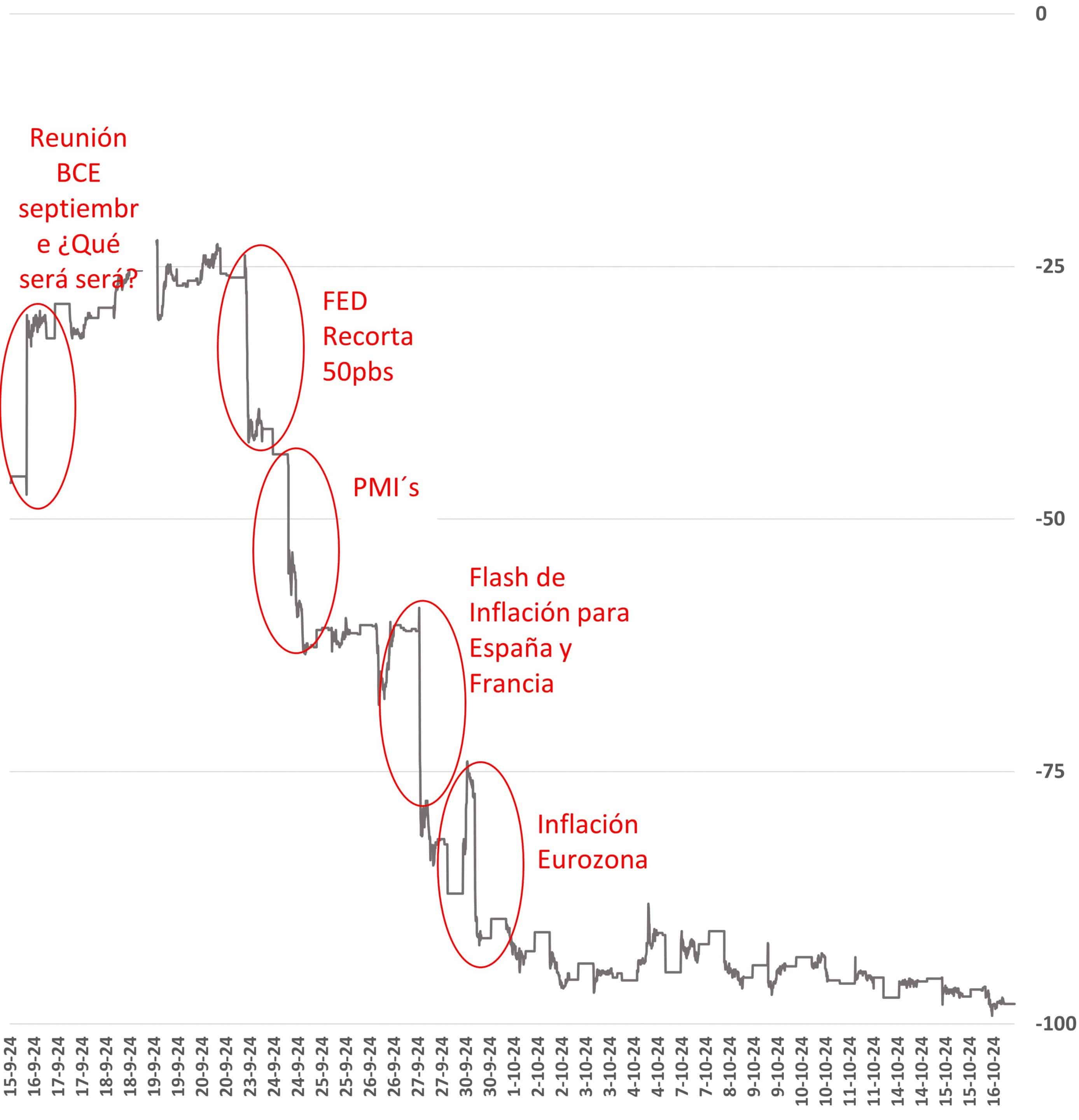

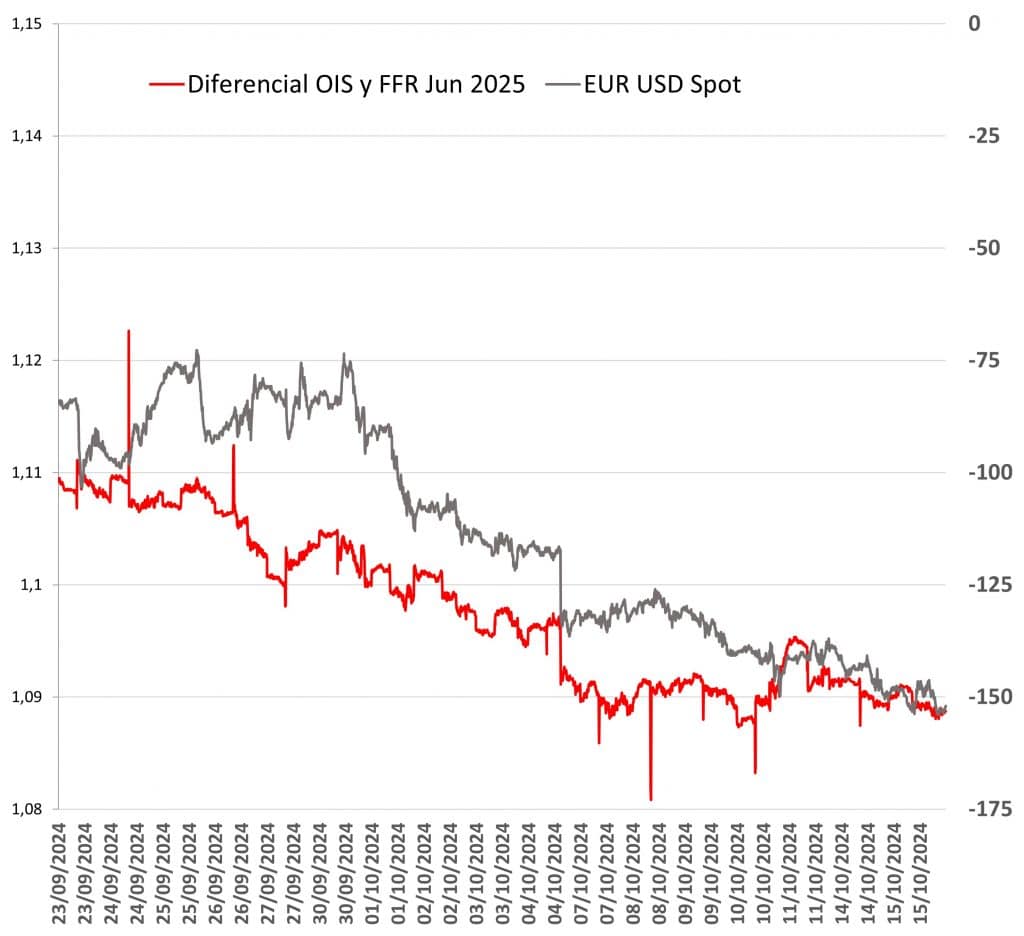

At its October meeting, the European Central Bank (ECB) announced a new 25 basis point (bps) interest rate cut. Factoring in the rate corridor adjustment made in September, this brings the marginal lending rate to 3.65%, the main refinancing rate to 3.45%, and the deposit facility rate to 3.25%. On the balance sheet front, there were no updates to the plan, so the current strategy of gradually reducing the balance sheet at a predictable pace remains in effect. With no update to macroeconomic forecasts, which were just released a month ago, the focus shifted to the rationale behind the decision (a pause had been expected). Key factors include weaker economic activity, lower inflation, and interest rate differentials (see Chart 1). As for forward guidance, the ECB, with a message that seeks to provide greater predictability, emphasized that its future moves will remain data-dependent, ensuring flexibility in its approach.

Chart 1: OIS rate cut probabilities for Oct 24

Source: MAPFRE Economics (based on Bloomberg data)

Assessment

This latest rate cut, despite the ECB’s cautious tone, signals that a turning point may be approaching. After this, the central bank could quicken its pace and move in a more consistent, predictable manner—setting the stage for more decisive action as early as December. Although still early, this scenario is taking shape around signals of modest economic growth, inflation aligning with the ECB’s target, and wage dynamics consistent with a normalizing labor market and well-anchored inflation expectations.

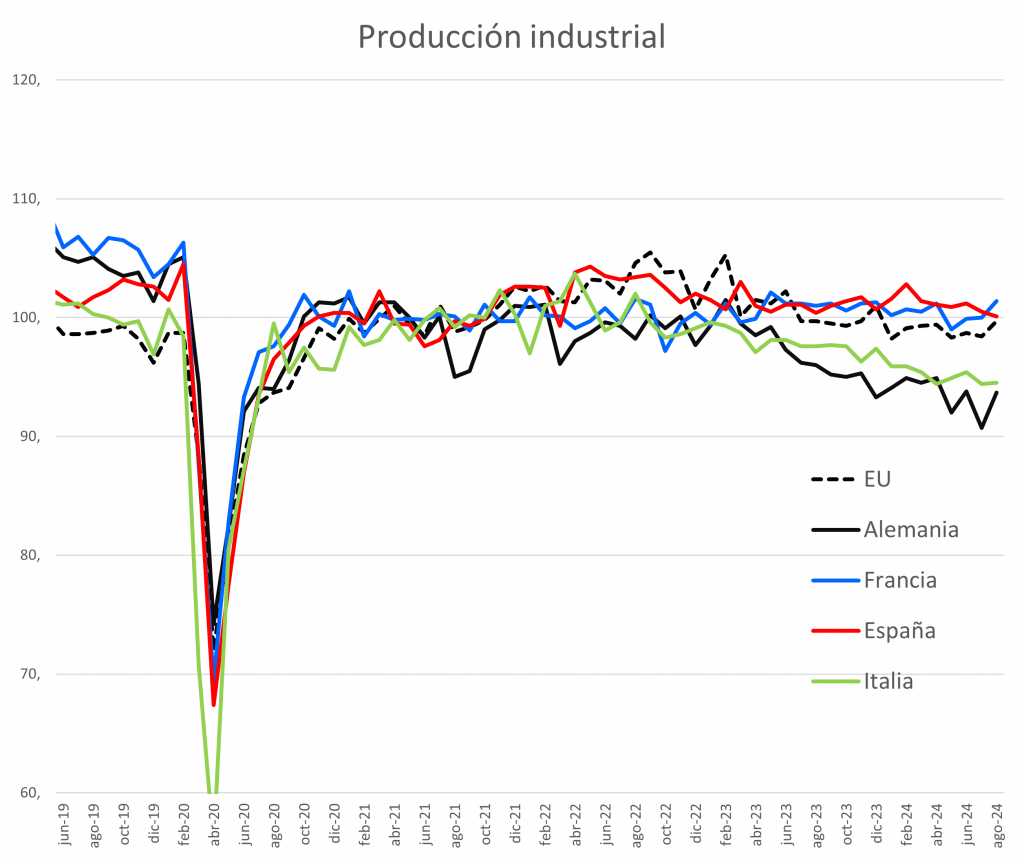

On the economic front, recent data continues to show persistent weakness, reinforcing expectations of prolonged sluggishness, especially in the Franco-German axis, where hopes for a second half recovery have faded. While industrial activity showed slight improvement, in line with the cyclical recovery forecast before summer (Outlook: Prospects for the second half of 2024), it highlighted that the barriers to sustained recovery remain structural (see Chart 2).

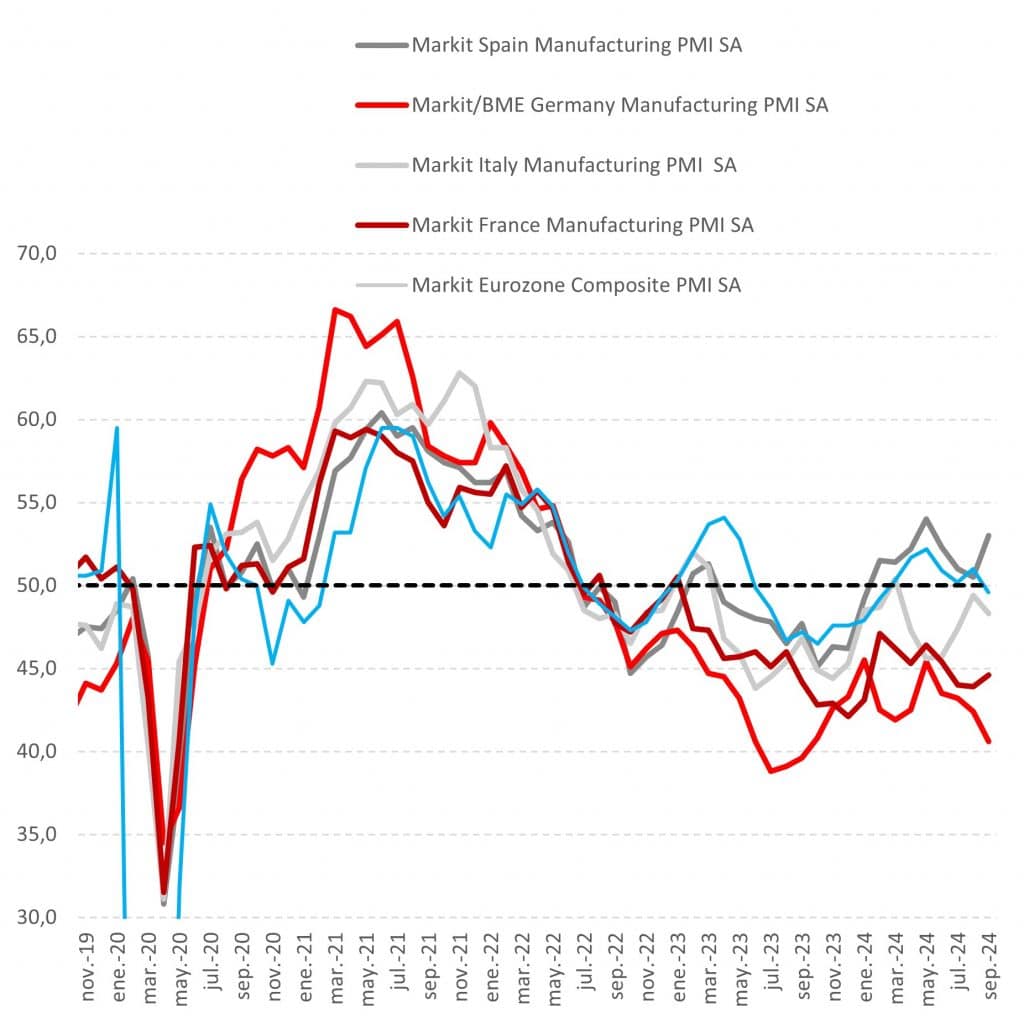

From a PMI standpoint, the composite index has again fallen below the expansion threshold, with the manufacturing sector reflecting continued underlying weakness. The services sector, while still growing, is expanding at a much slower pace, with monthly deceleration and uneven growth across countries (see Chart 3).

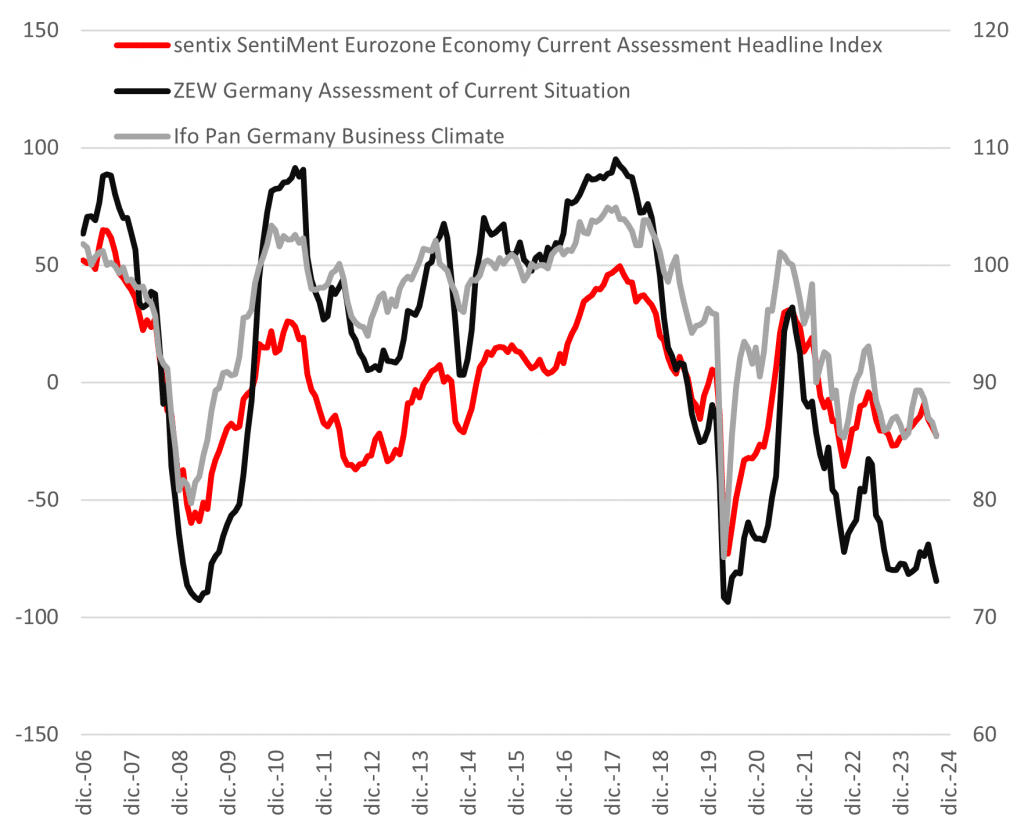

There are no encouraging signs on the credit front either. Lending surveys show little change, and the Investor Confidence Index (Sentix) remains firmly in negative territory. Recent surveys reflect a stagnating outlook. Similarly, both the ZEW economic sentiment survey and the IFO business climate index for Germany continue to show a deteriorating sentiment, with pessimism still prevailing (see Chart 4).

Charts 2 to 4: Industrial production, PMIs and Sentix, ZEW and IFO

Source: MAPFRE Economics (with Haver data)

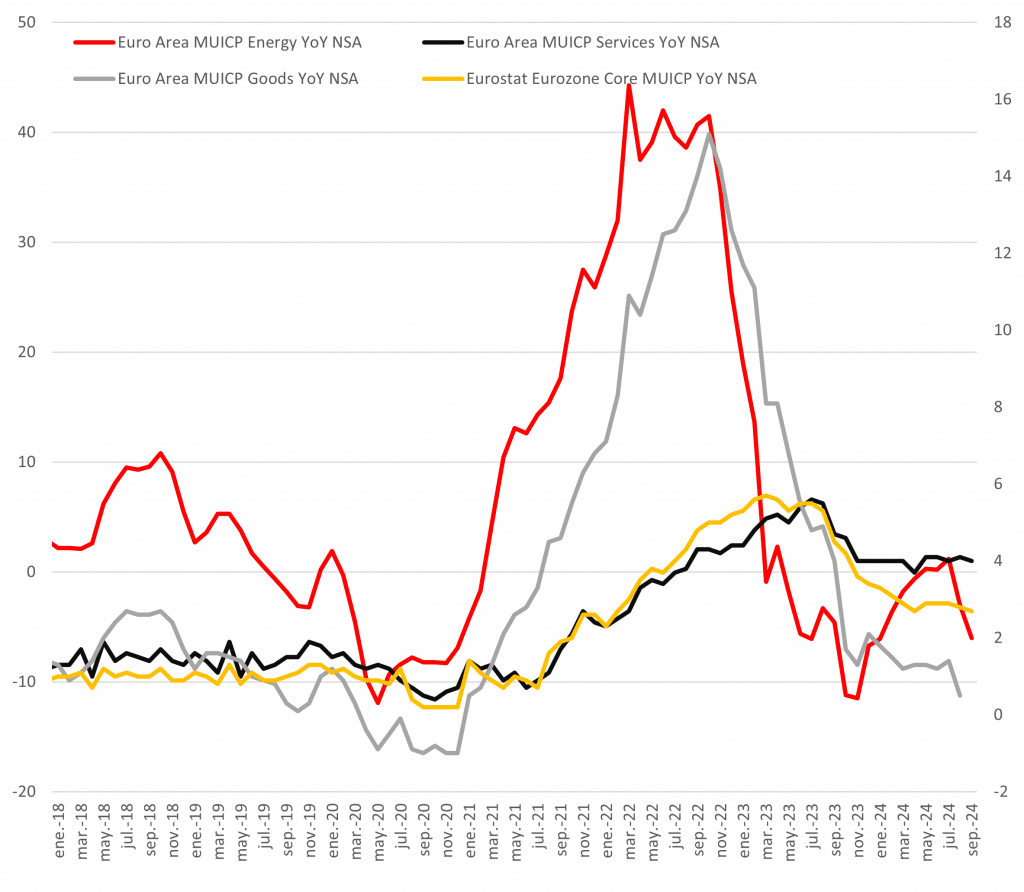

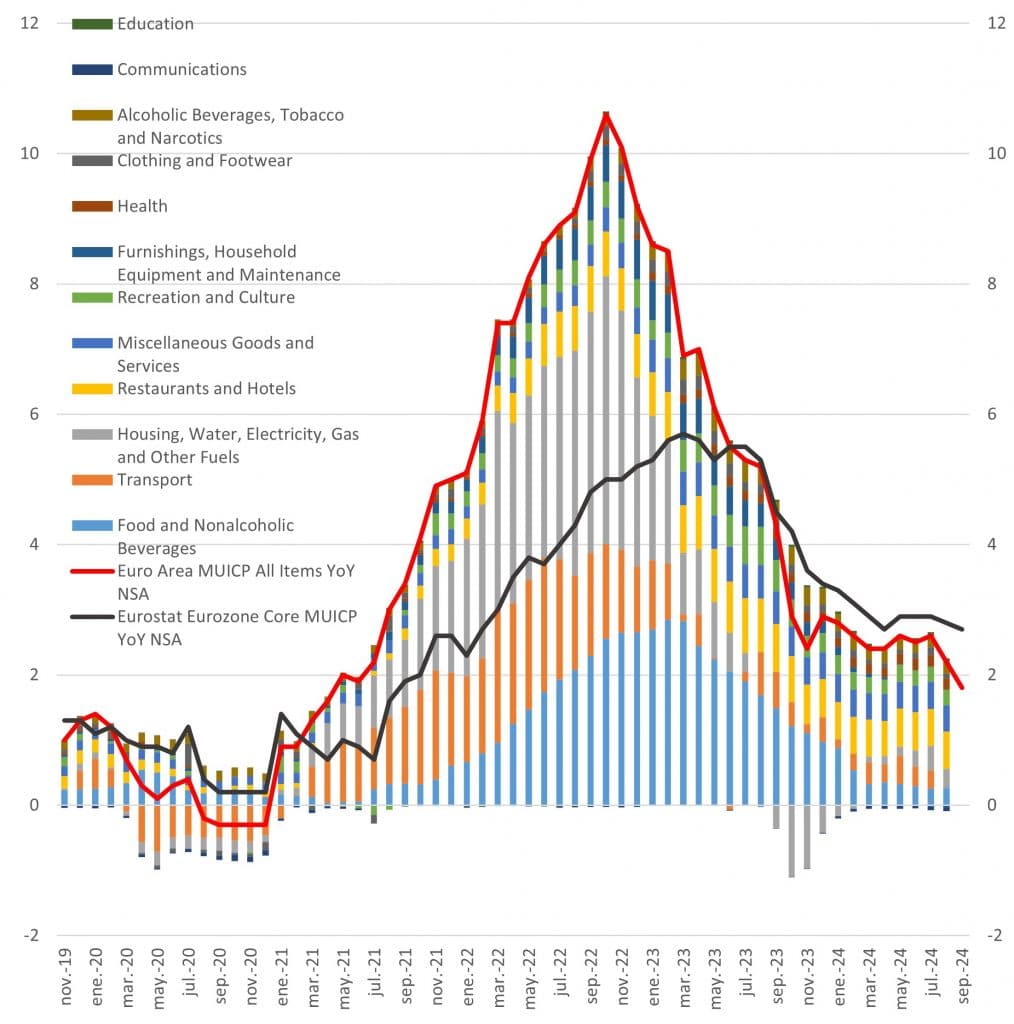

On a more positive note, from a “glass half-full” perspective, inflation continues to ease, dropping below the 2% target to 1.8% in September, largely driven by the energy component, despite a lack of moderation in the services sector. Core inflation also slowed to 2.7% year-on-year, reinforcing the outlook that, barring external shocks or significant wage pressures, inflation is likely to cool further beyond the base effects expected in the coming months. This trend would further smooth the ECB's path ahead (see Charts 5 and 6).

Charts 5 and 6: CPI by component and underly-ing metric

Source: MAPFRE Economics (with Haver data)

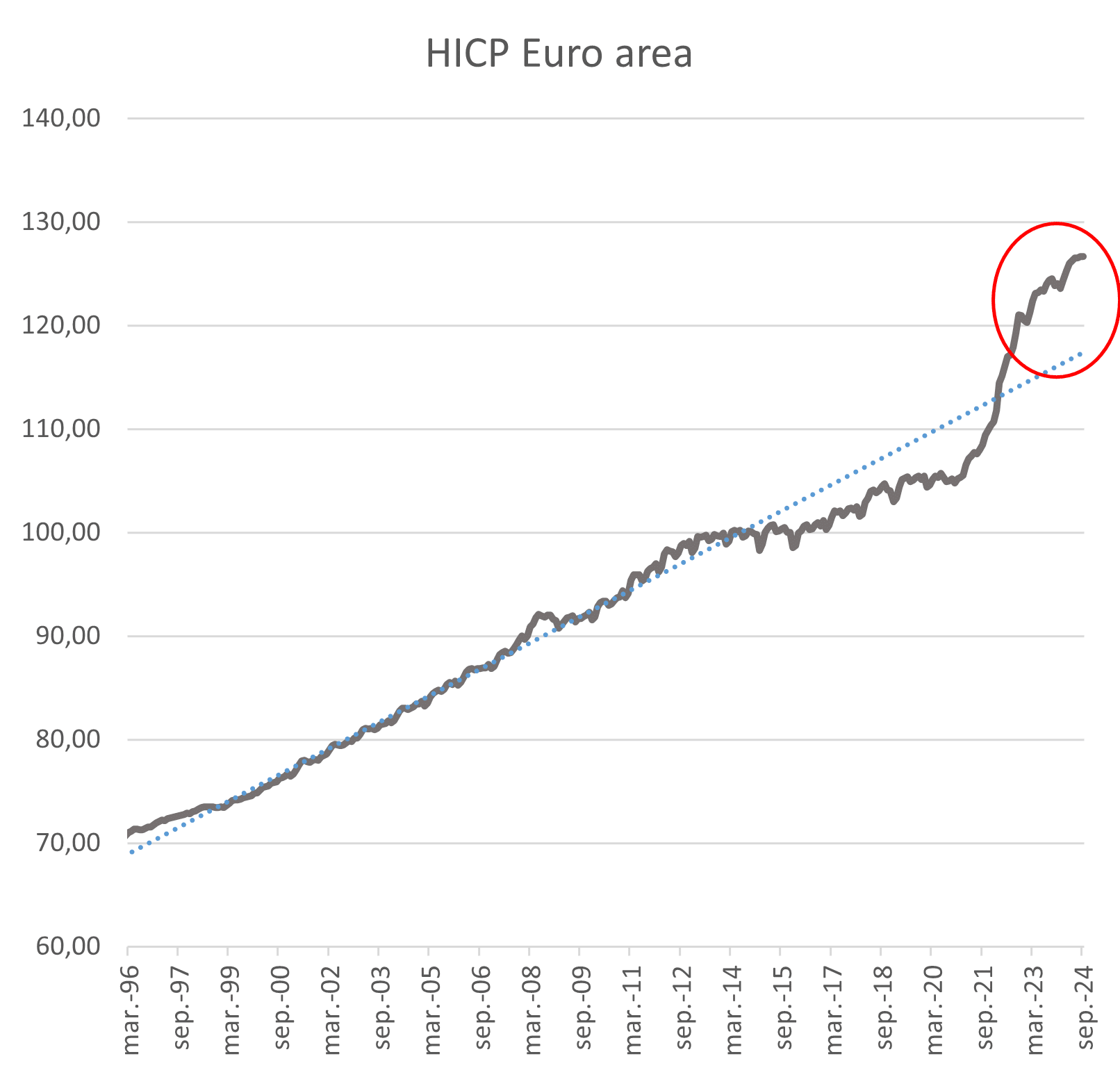

Regarding risks, external pressures remain unchanged, still vulnerable to uncertain geo-political developments. However, the internal outlook appears more positive. A wage-price spiral seems increasingly unlikely, and wage negotiations have yet to fully catch up with current price levels. This suggests that wage increases will help close the gap rather than destabilize future inflation expectations (see Chart 7).

Chart 7: Eurozone HICP

Source: MAPFRE Economics (with Haver data)

Internally, the options to delay a return to fiscal sustainability are dwindling, and while progress may be gradual, the path toward fiscal consolidation could become clearer in the 2025 budget negotiations. This is important because high government deficits could push up long-term bond yields, while also keeping attention on interest rate differentials.

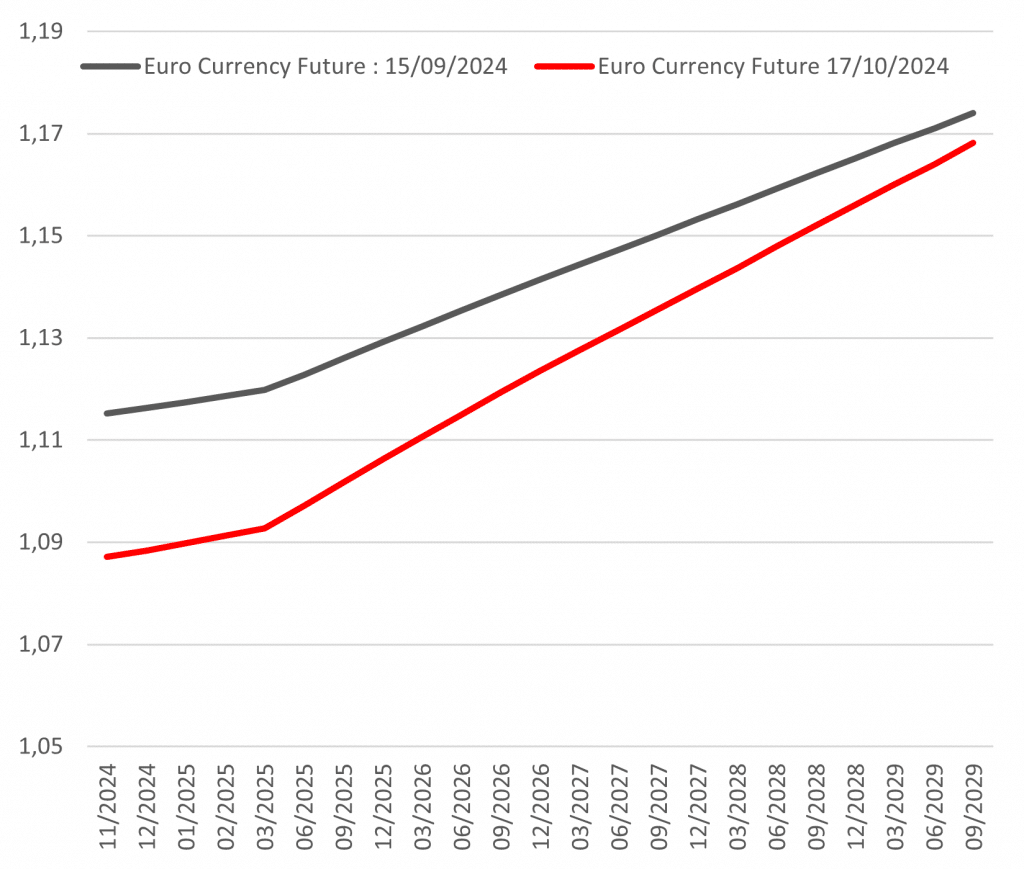

Given the lack of improvement in the macroeconomic outlook and the clearer trajectory for inflation, the ECB may find it justified to continue easing its policy. In fact, conditions are emerging for a steady, uninterrupted move toward the neutral interest rate. This shift toward more moderate expectations (see Charts 8 and 9), as the easing cycle progresses, offers some relief to a nearly stagnant Europe but does little to solve the long-term structural challenges. Reports by Draghi and Letta on Europe's competitive lag highlight these issues. Additionally, the risk remains that the euro’s recent weakness could become entrenched, further undermining European business competitiveness.

As economic theory, particularly from a Nobel laureate’s perspective, suggests, in a tariff-driven environment, the country imposing tariffs strengthens its currency, while the recipient country faces depreciation. The extent of this depreciation depends on the retaliatory actions taken.

Chart 8 and 9: Expected rate cuts from swaps for June 2025 and the EUR/USD futures curve performance.

Source: MAPFRE Economics (based on Bloomberg)