New rate cut: will we see a pause soon in the ECB's tightening cycle?

Redacción Mapfre

At its March meeting, the European Central Bank (ECB) announced a 25 basis point (bps) interest rate cut, bringing the rates to 2.90% for the marginal lending facility, 2.65% for the main refinancing operations, and 2.50% for the deposit facility. Regarding its balance sheet, no additional guidance was provided beyond the December outlook, meaning it will continue to be managed on autopilot for the time being. In terms of macroeconomic projections, new projections were presented, reflecting the persistent challenges facing the economy. Specifically, GDP growth was revised slightly downward to 0.9% for 2025, 1.2% for 2026, and 1.3% for 2027. On the inflation front, however, projections remained largely unchanged, with expectations for inflation to gradually converge towards the target: 2.3% in 2025, 1.9% in 2026, and 2% in 2027 (compared to 2.1%, 1.9%, and 2.1% previously).

As for forward guidance, Christine Lagarde’s message was more ambiguous than usual, reflecting the current climate of uncertainty, making the decision to preserve flexibility the most prudent approach. Given that neither inflation nor economic activity has shifted substantially in terms of predictions, committing to a specific trajectory would be premature. Instead, the ECB seems to be taking a “wait and see” approach, assessing how events unfold. This strategy buys time to analyze the potential impacts on the Eurozone economy, especially in light of current financial conditions that are "significantly less restrictive" than before.

Assessment

The recent rate cut was backed by a nearly unanimous decision (with only one abstention), driven by expectations of moderate future growth, the assumption that inflation will soon reach the 2% target, and, once again, a risk outlook tilted to the downside. Similarly, the consensus view is to refrain from committing to future moves until more data is available and its alignment with recent factors and developments can be fully understood.

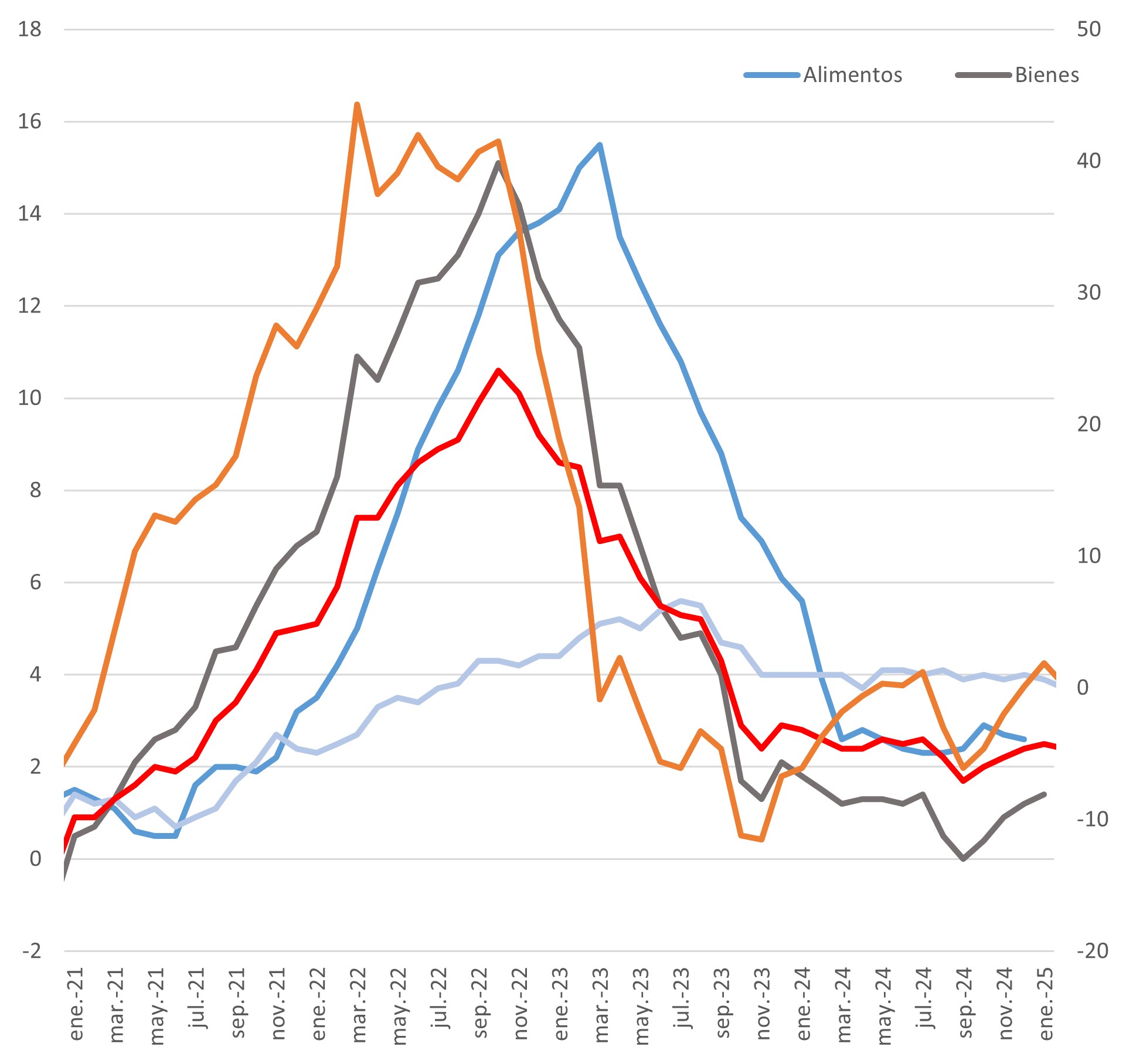

In terms of activity, high-frequency data (such as PMIs) continued to show some stabilization in the manufacturing sector, which offsets a slight slowdown in the services sector, resulting in a more balanced overall picture. Additionally, the IFO business climate indices indicated a modest improvement in expectations, which, when combined with the factors above, point to slightly stronger growth compared to the previous quarter, during which the economy nearly stagnated (see chart 1).

Chart 1: PMIs

Source: MAPFRE Economics with Haver data

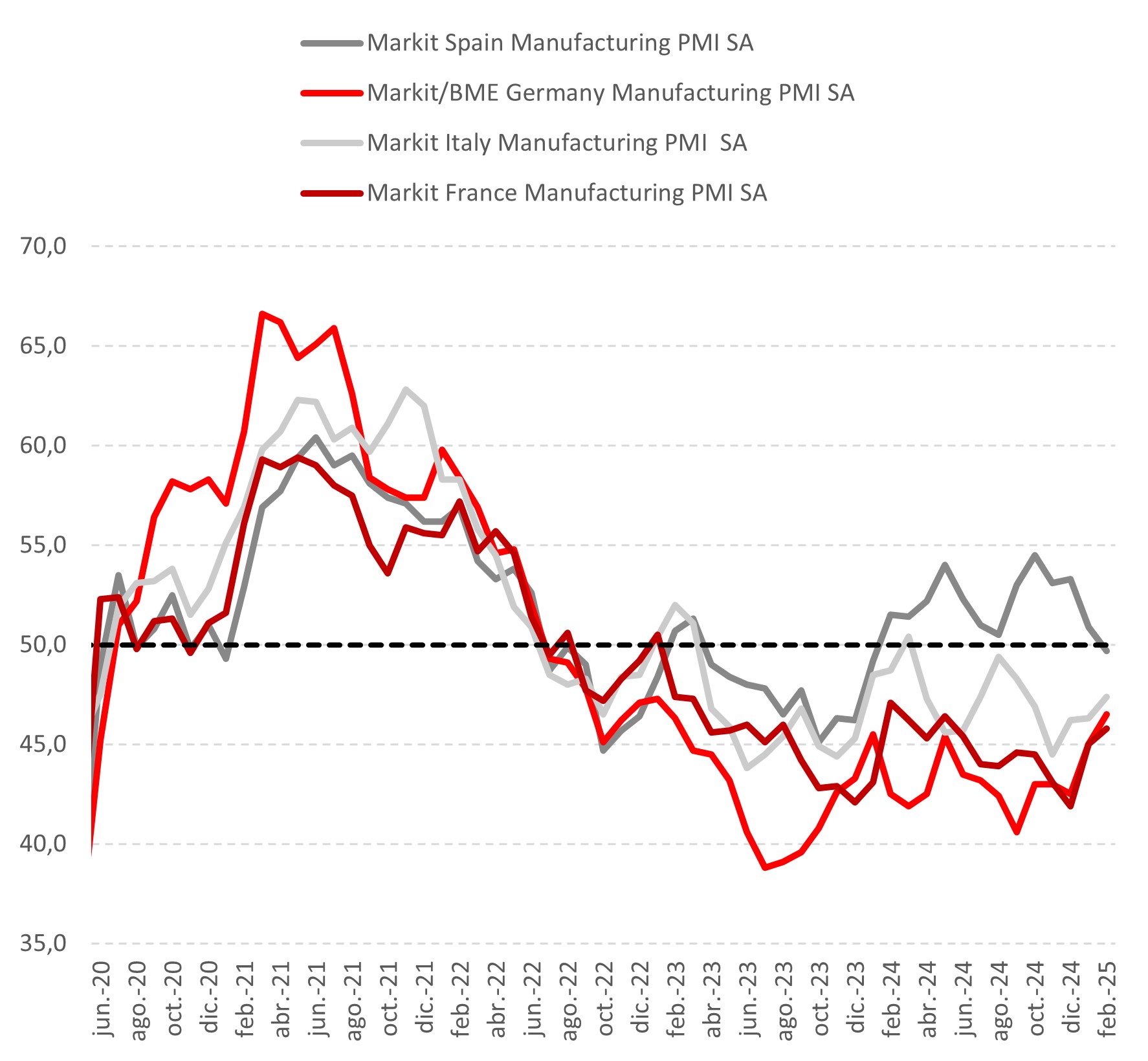

In terms of prices, there have been no major developments either. Inflationary pressures remain subdued, with January’s figure slightly more negative and February’s figure somewhat weaker. While the disinflationary trend has not worsened, it still does not reflect a sufficiently favorable outlook. Specifically, the February CPI decreased to 2.4% YoY (down from 2.5% in January), driven by a weaker contribution from services (3.7% vs. 3.9% in January) and energy (0.2% vs. 1.9% in January). By contrast, food and industrial goods contributions rose to 2.7% and 0.6%, respectively. Core inflation also moderated slightly, dipping by one tenth to 2.6% YoY in February (see chart 2).

Chart 2: CPI by components

Source: MAPFRE Economics with Haver data

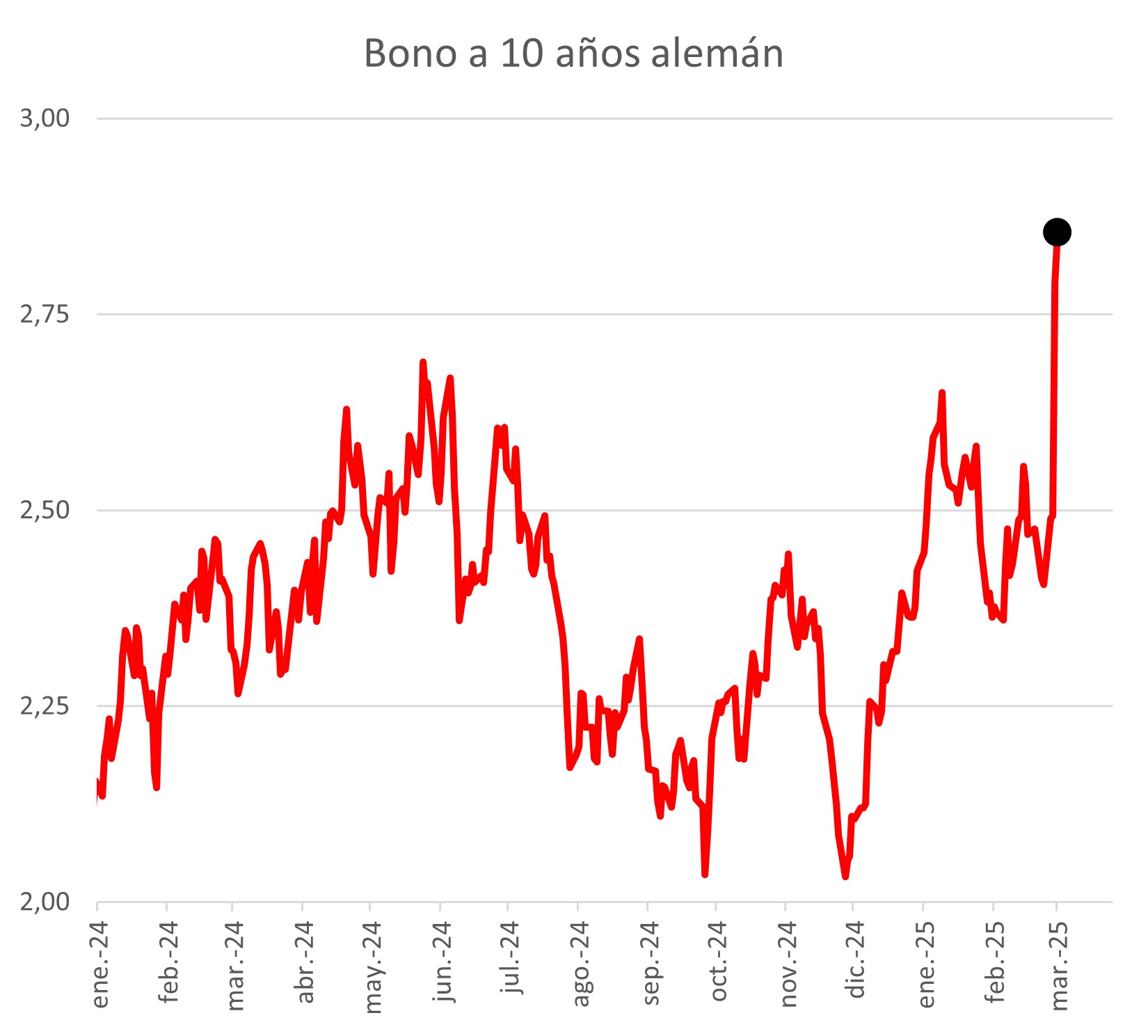

It is important to note that, given recent developments regarding the anticipated increase in defense spending, a sharp rise in bond market yields signals that fiscal policy will likely become more expansionary in the future (to finance the projected €800 billion increase in spending). Consequently, monetary policy will need to be more restrictive going forward. This reaction may signal a turning point for the terminal rate, as it tightens the ECB's reaction function (see chart 3).

Chart 3: 10-year German bond yield

Source: MAPFRE Economics with Bloomber data

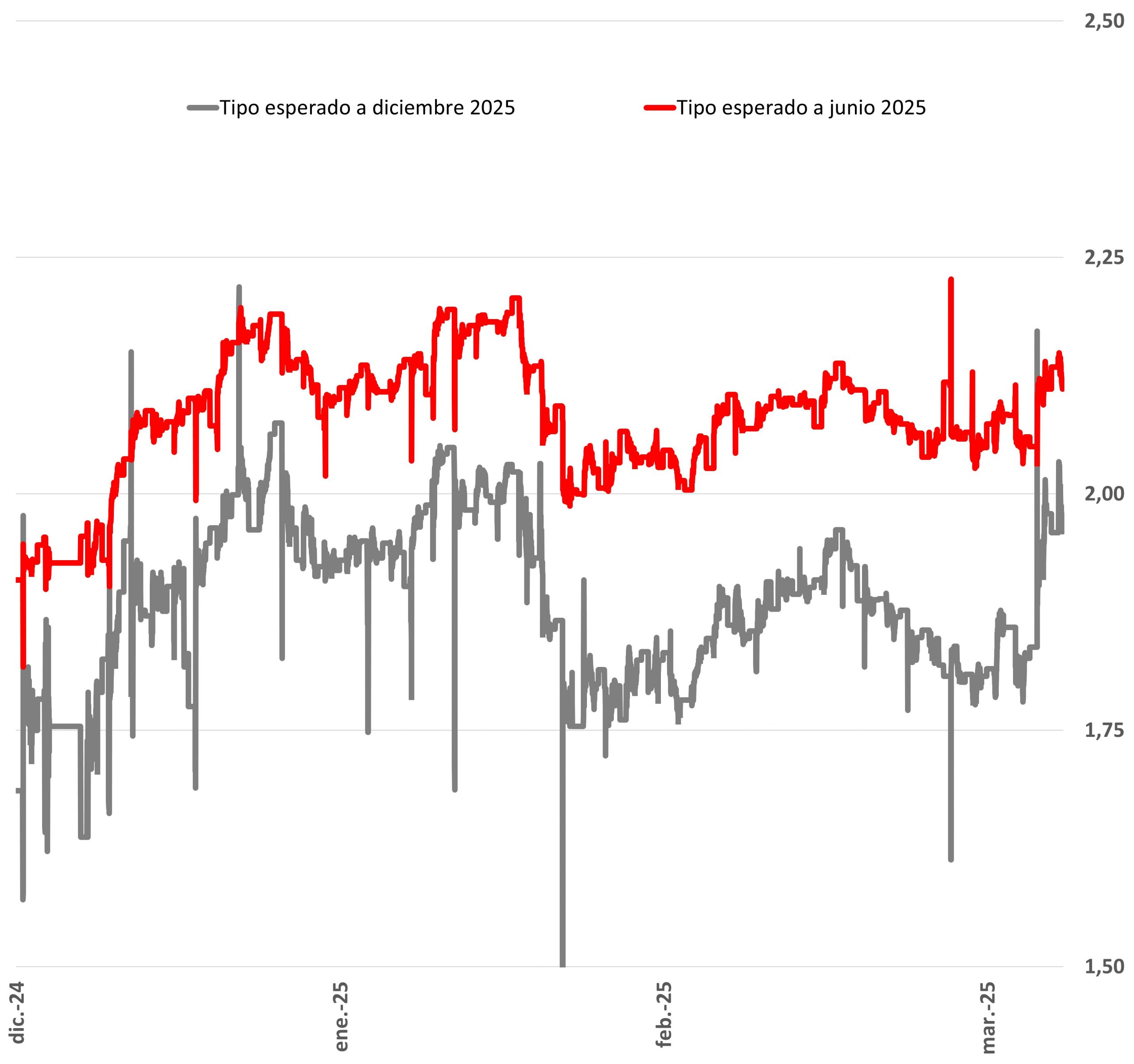

Since the December projections, the ECB had aimed to shift its policies toward a less restrictive stance, aligned with weak growth expectations and inflation gradually approaching the target. However, the current geopolitical context and the indirect effects of fiscal policy have created greater uncertainty, making it more difficult to foresee the path of monetary easing and leading the ECB to refrain from offering direct guidance on future moves (see chart 4).

Chart 4: Rates discounted by swaps

Source: MAPFRE Economics with Bloomberg data

In summary, while the macroeconomic outlook remains largely unchanged, the geopolitical context and the response function of European institutions have evolved. This has added a layer of uncertainty to the neutral interest rate and the ongoing debate sur-rounding it (according to the ECB's most recent estimates, it falls between 2.25% and 1.75%), underscoring the urgency to clarify its definition, as highlighted in the 2025 Economic and Industry Outlook. These factors contribute to shifting probabilities toward our alternative scenario, suggesting that a pause in the rate cutting cycle may occur sooner rather than later.