Market momentum continues, but can it hold up throughout the year?

Redacción Mapfre

Jonathan Boyar, director of Boyar Value Group and advisor to the MAPFRE AM US Forgotten Value Fund

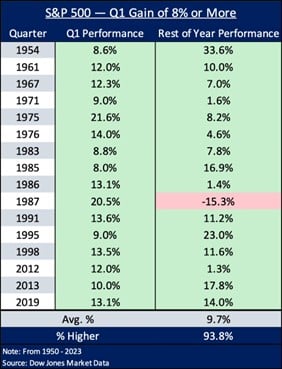

The S&P 500 increased by 10.2% during 1Q 2024, closing at a record high 22 times during the quarter—the highest figure since 1Q 1998 and a stark contrast to 2023, when it had no record closes throughout the year (the first time since 2012) despite advancing by 24%. (Note: The figures in this section are not inclusive of dividends.) From 1950 through 2023, the S&P 500 has gained 8% or more 16 times in 1Q. In 15 of those instances, it added to its gains throughout the year, for an average advance of 9.7% over the following 3 quarters according to Teresa Rivas writing for Barron’s. (In 1987, the one exception, the S&P 500 started the year with a blistering 20% advance for 1Q, but on October 19, Black Monday, it declined by over 20% in a single day—yet, remarkably, still finished positive for the year.)

Although a strong start to the year is generally a bullish signal, investors should curb their enthusiasm for spectacular gains for the rest of 2024: in 10 of those 15 years, the 1Q gains eclipsed those of the remaining 3 quarters combined.

AI mania and signs of froth

Investors continued their love affair with all things AI, sending Nvidia up 80% during 1Q 2024 (adding more than $1 trillion in market value to a market capitalization that now eclipses both Amazon’s and Alphabet’s)—and this after 2023’s standout performance, when shares more than tripled in value. Nvidia is now the biggest holding in individual investors’ portfolios, at ~9% (surpassing Tesla, previously the most popular stock), according to data from VandaTrack. Other stocks that investors believe will benefit from AI are drawing similar attention: Super Micro Computer Inc, and MicroStrategy, for example, advanced by 255% and 170%, respectively.

Signs of speculation in the financial markets abound (and make us somewhat nervous), with Bitcoin having advanced ~61% for the quarter after various Bitcoin ETFs were made available to the public. Similarly, the Donald Trump-controlled Truth Social sported a market cap of ~$8 billion at the end of the quarter (despite having posted tens of millions of dollars in losses since 2021 and having generated a paltry ~$4 million—not a typo—in sales in 2023) before falling ~44% thus far in April. Similarly, social media company Reddit, which has never posted a full-year profit since its founding in 2005, advanced 48% on its first day of trading as a public company and is valued at ~$7 billion.

Did I miss the rally in stocks?

After a large 2023 rally in U.S. equities, followed by a strong 1Q, many investors (professional and individual alike) might feel as if they have missed their chance for outsized gains and turn to money market funds, where they can currently obtain yields of almost 5% while taking minimal risk—a significant improvement from the near 0% rates savers have resigned themselves to in recent years.

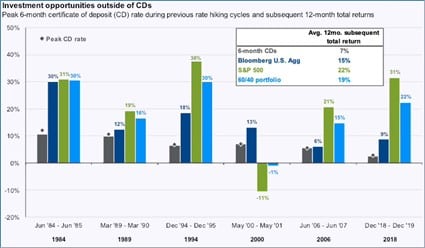

However, investors should keep in mind that over a 2-year period, the S&P 500 has advanced 20% (a solid return no doubt but nothing out of the ordinary by historical measures)—and for those looking to invest in smaller companies, the Russell 2000 is 15% below its 2021 record. In addition, if history is any guide and rates have in fact peaked, we could be in for near-term equity outperformance. Since 1984 there have been six rate hiking cycles, and according to data from JP Morgan, cash tends to underperform both stocks and bonds the year after rates peak (five of the last six times). Either way, trying to time the market is usually detrimental to long-term returns.

The wisdom of taking a long-term view

We’ve said it before, and we’ll say it again: individual investors stack the odds of investment success in their favor when they stay the course and take a long-term view. According to data from JP Morgan, there has never been a 20-year period when investors did not average a gain of at least 6% per year in the stock market.

Past performance is certainly no guarantee of future returns, but history does show that the longer a time frame you give yourself, the better your chances become of earning a satisfactory return