High levels of debt and deficit threaten global growth

Redacción Mapfre

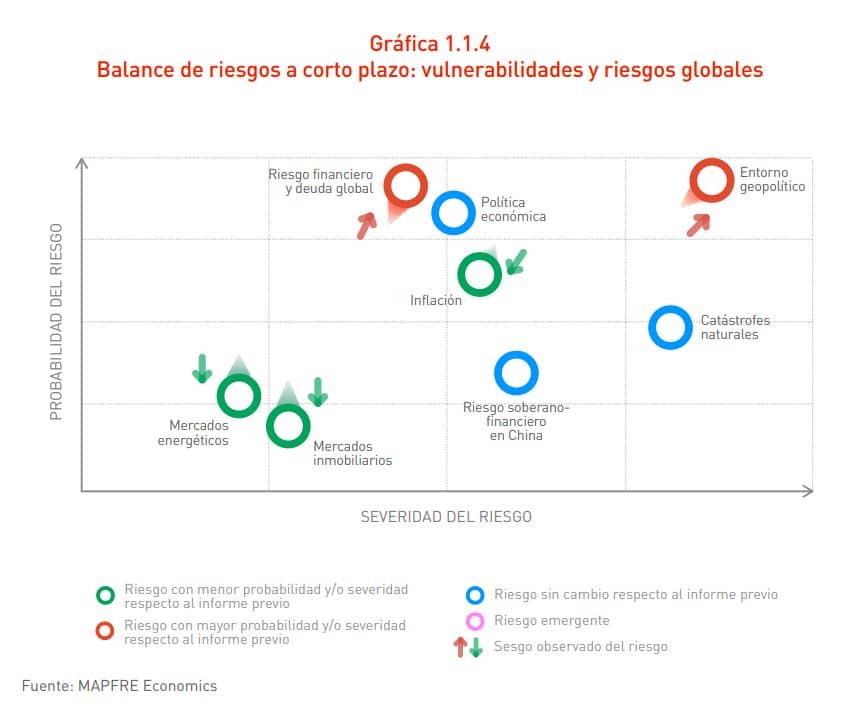

High levels of debt and deficit in many countries are among the main medium-term risks to the stability of the financial system. Both the financial system and the real economy may be impacted by public and private leverage aimed at sustaining dynamism, as detailed in the report “Economic and Sectoral Outlook 2024: Prospects for the Second Half of the Year,” by MAPFRE Economics.

In the United States, a fiscal deficit of nearly 7% is anticipated this year, amidst a projected economic growth rate of around 2.1%. Meanwhile, the government is expected to work toward managing public finances and reducing federal debt, which stands at 122% of GDP.

When including federal, state, and local debt, the total debt amounts to 135% of GDP. The Congressional Budget Office has warned that the debt is on an unsustainable path, and if interest rates stay high, the burden of interest payments could become unmanageable. In August 2023, the rating agency Moody’s downgraded the US from AAA to AA+. In short, even if the Federal Reserve cuts interest rates, markets might still demand high rates to purchase US debt if concerns about the direction of US debt remain.

In Europe, the exceptional period following the pandemic has come to an end, and the fiscal rules that were temporarily suspended have now been reinstated. Thus, at the end of June, the European Commission opened an Excessive Deficit Procedure for seven European countries, including France and Italy. With respect to risk, countries must either scale back their deficits, which could lead to lower growth and austerity effects, or face the possibility that markets may begin to put pressure on sovereign debt, with potential knock-on effects on private corporate debt.

This is happening in a context where major central banks are reducing their balance sheets and selling global sovereign and corporate assets, which is exerting additional upward pressure on the returns expected by the market for such debt.

In emerging markets, while pressure on sovereigns may not be as pronounced, there are risks associated with debt issued in hard currencies (e.g., Turkey and Argentina). Against the backdrop of financial constraints, this could complicate efforts to roll over and repay their debt.

Financial risk is not the only risk highlighted by MAPFRE Economics in its Outlook report. China’s real estate market continues to face challenges: housing sales dropped by 27% in June, while construction starts decreased by 24% for office properties and 25% for residential properties. On the geopolitical front, analysts are highlighting tensions between the EU and Russia following the visit of Hungarian Prime Minister Viktor Orbán to Moscow in July, which “has generated significant controversy.” Additionally, there are concerns related to cybersecurity, the recent French legislative elections on July 7, 2024, and the ongoing war in Gaza, which shows no signs of resolution.

Inflation continues to lurk in the background. Although global headline inflation figures continue to show downward moderation, it is encountering resistance towards the end of its path due to ongoing supply constraints, particularly in the services sector. Therefore, achieving the central banks’ short-term headline price growth target of around 2% is viewed as difficult in the near term. Alarm bells may also be set off by the energy and housing markets, economic policy, and natural disasters.