The ECB is ahead of market expectations

Redacción Mapfre

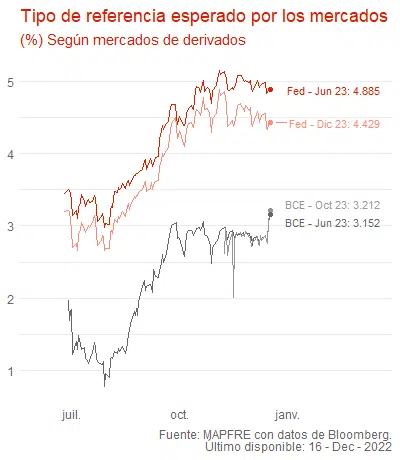

Last week, the ECB was hawkish. This shows the inconsistency we have often talked about in recent weeks: the consensus forecast for European inflation and ECB rates is incompatible. With inflation expected at 6% by 2023, you can't think that the ECB will stop rate hikes at 3%. Therefore, either the inflation expectation changes, or the rate expectation changes, with consequences for the market.

Mme. Lagarde's language was clearly aggressive. She said that the ECB "is not pivoting" or that a 3% rate is "clearly not enough". Moreover, the ECB's economic forecasts confirm this. Although growth is very low, they see the labor market tight, and inflation elevated.

Therefore, the market increased the expected rate, with negative consequences for both bonds and stocks. But very little. If Mme. Lagarde's speech is correct, the ECB's terminal rate should be closer to 4% than 3%. Thus, it still has a long way to go. And liquidity will suffer as well. But that would correct the incoherence we have been talking about.

Conversely, the speech could be just a warning to the market and not real. In that case we would have a different and less immediate problem: the credibility of the ECB. Because its speech would not match its real intentions and because it is facing a very high inflation for the first time in its history. This problem is much worse.

That is why I think the speech is serious. As a consequence, European yield curves should rise and invert further. And this may also imply a turnaround in the equity market. Companies that have benefited from the expectation of a "pivot" in the last two months could suffer. On the other hand, the situation favors companies that are more resilient to a rising rate environment.

Text by Alberto Matellán, chief economist of MAPFRE Inversión.